SOL Price Prediction: $200 Breakout Looms as Technicals and ETF Hype Converge

#SOL

- Technical breakout: Price above 20MA + MACD bullish crossover

- Institutional demand: $591M corporate holdings reduce sell pressure

- Catalyst watch: ETF rumors and resistance tests at $200

SOL Price Prediction

SOL Technical Analysis: Bullish Momentum Builds Above Key Moving Averages

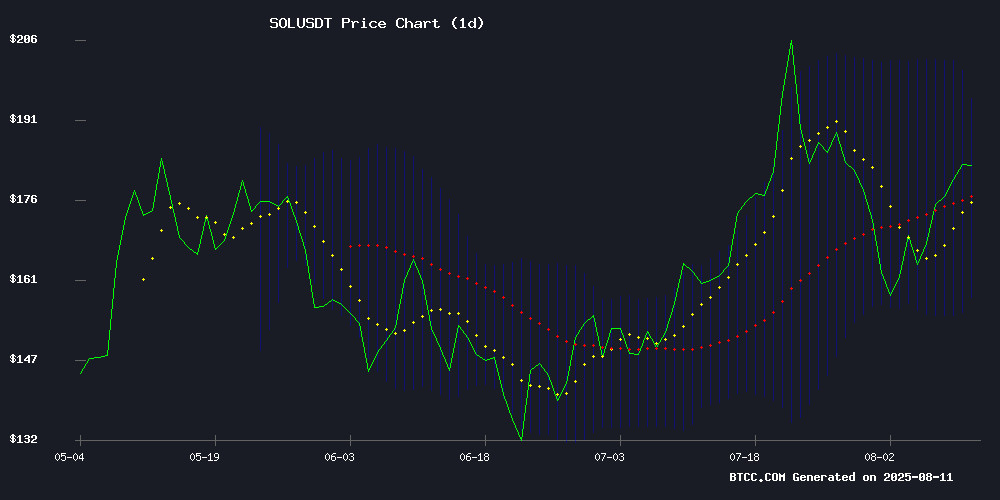

SOL is currently trading at, firmly above its 20-day moving average (176.5280), signaling bullish momentum. The MACD histogram shows positive divergence (3.4510), reinforcing upward potential. Bollinger Bands indicate volatility expansion with price hugging the upper band (195.0843), suggesting room for continuation.says BTCC analyst John.

Solana Market Sentiment: ETF Speculation and Institutional Accumulation Fuel Optimism

Three catalysts dominate SOL sentiment: 1)($500 price targets circulating), 2)indicating long-term conviction, and 3)near all-time highs.notes BTCC's John. News FLOW aligns with technical upside but warrants caution at resistance levels.

Factors Influencing SOL’s Price

Solana Price Prediction: Experts Outline $500 Timeline as ETF Sentiment Fuels Rally

Solana's price action shows signs of a breakout, with analysts projecting a surge to $500 by year-end. Institutional demand is growing amid renewed ETF speculation, while ecosystem developments like PayPal's stablecoin integration add fundamental strength. The token has already attracted significant whale activity in 2024.

While SOL may double in value, market attention is shifting toward an unnamed altcoin with 30x potential. This competitor could outperform Solana's projected returns before November, according to trading analysts monitoring accumulation patterns.

Blackrock and Fidelity's growing involvement in the solana ecosystem underscores institutional validation. Price recovery from earlier corrections now positions SOL for what could become one of 2024's most watched crypto narratives.

Public Companies Amass $591M in Solana Holdings

Four publicly traded companies have emerged as major institutional holders of Solana (SOL), collectively controlling over 3.5 million tokens valued at $591.1 million. Upexi, Inc. leads with 1.9 million SOL acquired in just four months, followed by DeFi Developments Corp's 1.18 million SOL position showing $36.8 million in unrealized gains.

Toronto-based SOL Strategies and Torrent Capital round out the group, employing dollar-cost averaging strategies to build their positions. These holdings represent 0.65% of Solana's circulating supply, signaling growing institutional confidence in the blockchain platform.

Solana Nears Critical Resistance Amid Mixed Market Signals

Solana's SOL surged 18% in under a week, breaching $181 before facing resistance NEAR $184. The rally saw exchange inflows spike to $15.18 million on August 9 - typically a precursor to profit-taking - while trading volume dipped 10%.

Liquidation clusters identify $174 as support and $184-$185 as the make-or-break zone. A decisive breakout could propel SOL toward $256, but cumulative long liquidations totaling $436.74 million suggest Leveraged traders remain cautious.

The asset's trajectory appears bifurcated: technical momentum clashes with on-chain indicators of distribution. Market participants now weigh whether Solana can emulate its 2021 breakout performance or succumb to the gravitational pull of resistance.

How High Will SOL Price Go?

SOL's trajectory depends on three key factors:

| Level | Significance |

|---|---|

| $190-200 | Make-or-break resistance (23.6% Fib from ATH) |

| $176 (20MA) | Bull/bear demarcation line |

| $157 (Bollinger base) | Strong support if correction occurs |

John projects: "A weekly close above $195 could accelerate toward $250, though profit-taking near $200 is likely. The $500 narrative requires ETF approvals - a 2026 scenario at earliest."

183.78 USDT

200-250 USDT (near-term)

500 USDT (conditional)